The Management of Ghana Interbank Payment and Settlement Systems (GhIPSS) said it would embark on aggressive public education to whip up interest in the Instant Pay Service as part of efforts to drive the cash-lite agenda.

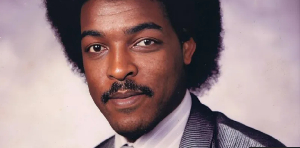

The Chief Executive of GhIPSS, Mr Archie Hesse, said efforts were being made to make payments hassle-free and that Instant Pay would be on top of the agenda in 2017.

“We are now in an era where, from your home or office, you can receive and send money around and that brings efficiency to your life,” Mr Hesse said, adding; “this is essentially what Instant Pay does and we should enjoy this great benefit of technology”.

The institution, together with the banks, plans to roll out education programmes and activities to ensure that the public is fully aware of the availability of the Instant Pay Service and appreciate its enormous benefit in order to patronise it repeatedly.

Just as the name suggests, the Instant Pay is a service that enables a bank account holder to transfer money from his account to the account of another customer of a different bank and the intended recipient will receive the money instantly.

The introduction of the Instant Pay adds to the plethora of electronic payment options available to the public.

Several banks have owned the Instant Pay and developing various products around it. Some have also linked it to mobile phones which enable their customers to transfer money from their bank accounts to another instantly using their mobile phones, under secured system.

Mr Hesse said these developments, coupled with the planed public education, were expected to make Instant Pay one of the most patronised services in 2017 and beyond.

The Instant Pay is currently the preferred electronic form of payment globally with most of the advanced countries using the payment system for multiple banking services.

Although the main intent of the service is instant interbank transfers, the underlying infrastructure enables banks to launch game-changing products and services that provide real customer value and position the banks at the centre of the payment process.

Business News of Tuesday, 17 January 2017

Source: GNA

Instant Pay Service tops the agenda in 2017 - GhIPSS

Entertainment